Exploring a Colorado Cash Dividend

Building a future where every Coloradan has an economic floor.

Why a cash dividend for Colorado?

Between February and June 2025, the Denver Basic Income Project led an exploration into what a statewide cash payment could look like in Colorado. Partnering with researchers, advocates, and the public, we examined:

Who should receive a dividend - jump to section

How to sustainably fund it - jump to section

What Coloradans think about the idea - jump to section

Who could benefit?

Our modeling looked at dozens of approaches, focusing on three major strategies:

-

Prioritize Children

We looked at a variety of approaches that made households with children the focus of a Colorado cash dividend; examining regular monthly cash assistance in the first year of life, between ages 0 and 5, and a lifetime benefit that starts at birth. For example, a $500 per month cash dividend for the approximately 373,000 households with a child between ages 0 and 6, would cost roughly $1B per year.

-

Target Poverty

Colorado spends nearly $3 billion in federal and state funds to support households in poverty. With nearly half of Colorado households earning less than median income (~$100K/year), an income-based approach is another possible way to help those most in need as early as possible. By the 10th year of a program providing direct cash assistance to households in poverty, annual costs would reach $665M per year for a $1,200 per year benefit to $3.5B per year for a $6,000 per year benefit.

-

Launch Locally

Following the example of RXKids in Michigan, which took a local approach where the lowest income counties are the focus for universal first year of life benefits for households with newborns, we looked at how a similar approach could work in Colorado. In one similar approach, providing the highest dividend of $6,000 per year to children 0-5 for the lowest income counties and scaling up to medium level counties would benefit 45,000 children by the 10 year at a cost of $276M.

Funding a Permanent Dividend

We partnered with the Colorado Fiscal Institute to map out practical ways Colorado could fund a permanent fund. As digital services and AI reshape our economy, the memo outlines policy options that either tax wealth or bring currently untaxed parts of the economy into the mix. With a short start-up period to let the fund grow and earn investment income, Colorado could sustain a fund backed by up to $300 million a year.

We grouped the revenue ideas into three buckets: sales and service taxes, digital and data economy taxes, and taxes on wealth. Below are the leading options in each bucket that could reliably support a permanent fund:

Expanding sales tax to services (+$194M annually)

Taxing digital advertising (+$200M annually)

A tax on the sale of personal data (+$28M–$200M annually)

A 1% tax on capital gains for millionaires (+$300M annually)

A state Net Investment Income Tax (+$360M annually)

What does the public think?

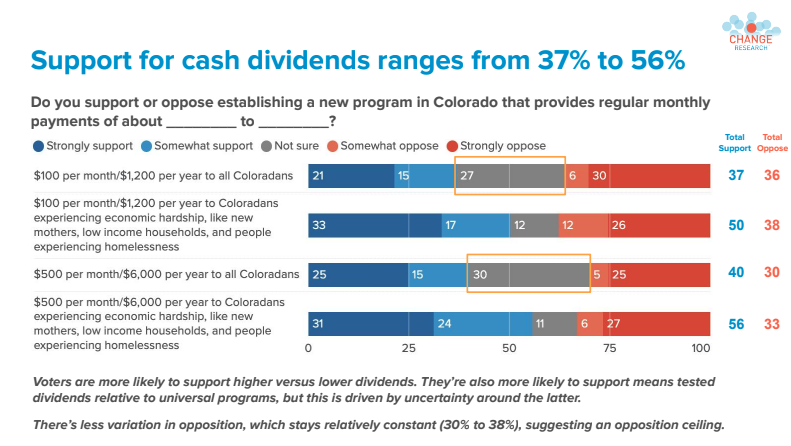

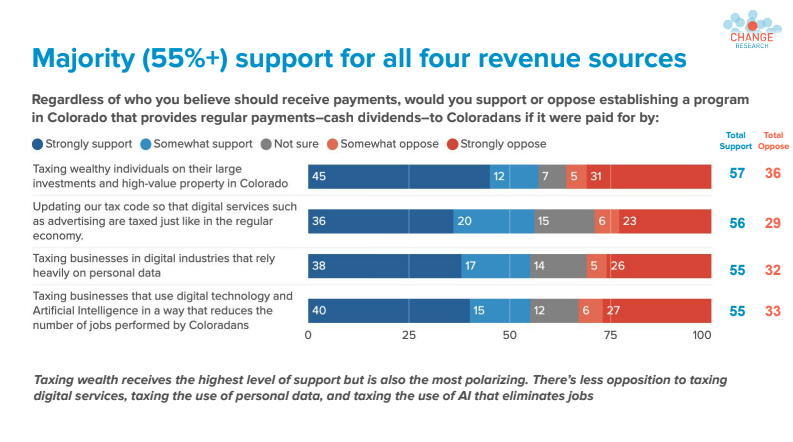

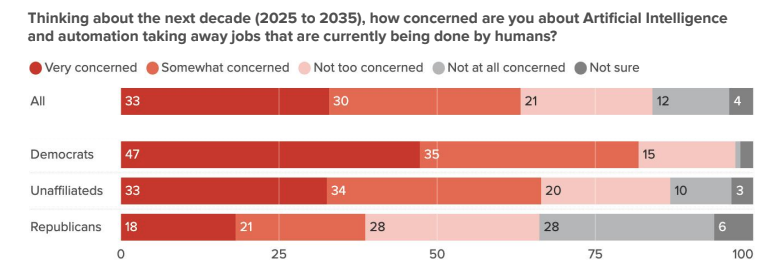

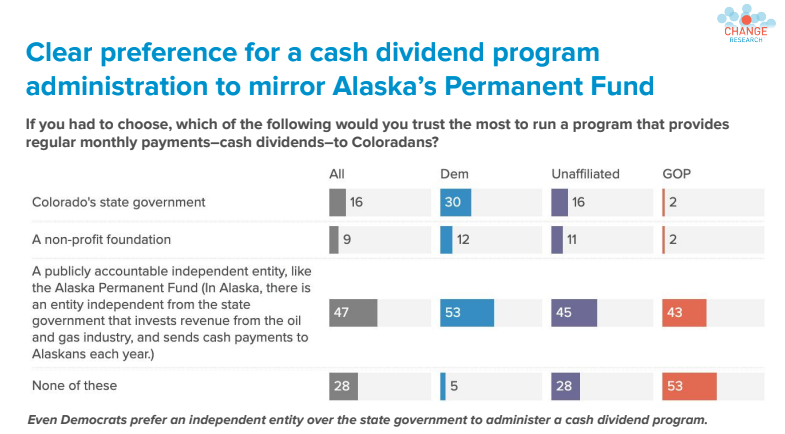

Those two analyses led to our final step: polling a sample of likely 2026 Colorado voters. From July 8–12, we surveyed 800 voters to get a read on attitudes right after HR 1 passed.

Here are the highlights:

Hear how we’re talking about the Colorado Cash Dividend at a national scale.

Listen to Mark Donovan, founder of the Denver Basic Income Project, talk about the looming threat of AI and the power of a Colorado Cash Dividend at the 2025 BIG Conference, held at the National Press Club in Washington D.C.

What’s Ahead for Colorado

This exploration shows that Coloradans are open to the idea of a cash benefit and have clear preferences for how this kind of program should be structured and funded. The results of the exploration pointed to a strong public inclination toward a cash benefit that taxes wealth or elements of the digital economy to create an economic floor for those below the poverty line.

But more work lies ahead:

Continued public education about the need for an economic floor

Engaging Coloradans on funding options

Building a coalition to support future legislation

Sign up via the button below to learn more about the Colorado Cash Dividend work and receive our full research reports.